Take Advantage of These Clean Energy Tax Credits While They Last

August 26, 2025

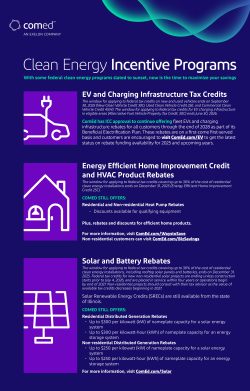

With select federal tax incentives for clean energy technologies—like electric vehicles (EVs), EV charging infrastructure, solar panels, and heat pumps—set to expire as soon as this fall, ComEd is reminding customers to take advantage of these tools to lower their costs in the switch to clean energy.

Starting on September 30, some federal incentives will no longer be available: New and used EV tax credits (New Clean Vehicle Credit 30D, Used Clean Vehicle Credit 25E, and Commercial Clean Vehicle Credit 45W). Starting on December 31, 2025, the 25C tax credit for home energy efficiency upgrades, and the 25D tax credit for residential solar will also expire.

Until then, ComEd customers are encouraged to review the federal EV, home energy efficiency, and solar tax credits, AND to consider taking action to claim funding, along with ComEd programs that will still be available to customers. Combining both ComEd incentives and federal tax credits can help customers maximize savings of clean technologies. Adding many of these clean energy technologies can help customers optimize their energy use, making their net energy costs cheaper in the long run.

If you’ve been considering making the switch, now is the time. Read on to learn about federal offerings and to see what ComEd rebate programs you can take advantage of today.